When running a business, keeping an eye on revenue and sales is essential. In the retail industry, one of the most important metrics to pay attention to is your gross sales.

Because running a retail business requires a lot of overhead—the cost of goods sold, website management, and shipping, as well as rent and utilities for brick-and-mortar stores—knowing your gross sales is key to staying afloat.

This article will discuss gross sales, how they are calculated, and what they can tell you about your business.

How to calculate gross sales

The formula to calculate gross sales is Total Units Sold x Original Sale Price = Gross Sales. A company's gross sales are the total sales of all its products and/or services over a period of time. Known as top-line sales, the number represents the total revenue of a business without deductions, returns, or allowances.

Gross sales vs. net sales

Now that we know what gross sales are, let's talk about its cousin, net sales. Together, these metrics give business owners a bird's-eye view of their business's progress.

Gross sales shows the company’s total revenue, whereas the net sales show its overall profit.

Gross sales formula

You can calculate your gross sales by using the following formula:

Total Units Sold x Original Sale Price = Gross Sales

There should be no discounts, allowances, or returns included in this figure. The purpose is to get a sense of the overall revenue of your business within a selected period of time.

For example, to know how your business is doing in a given month, you might examine both monthly and yearly gross sales.

Net sales formula

Using the following formula, you can determine your net sales:

Gross Sales - Discounts - Allowances - Returns = Net Sales

You'll be deducting these three items from your gross income:

- Discounts for early payment of invoices on wholesale orders: Promotional or sales discounts are excluded.

- Sales allowances: Also known as rebates, these are reduced sales prices due to faulty products. Products might be put on clearance if defects have been detected in-store, but this also applies to when customers return defective products. If they decide to keep the product, you can refund a portion of the purchase price, or they can return the entire order.

- Refunds and returns: This includes any product returns. The customer may have been disappointed due to product quality, shipping delays, incorrect items received, or the product not being what they were expecting.

You can use the net sales or net income to calculate your company's profit. Gross sales are equal to the sum of all sales, while net sales subtract all discounts, allowances, and returns to calculate your company's profit.

Understanding both numbers is crucial to your financial statements. Gross sales, however, gives you a clear picture of how your business is performing overall and how many sales transactions are actually taking place.

Understanding the gross sales formula

You've already learned the basic formula for gross sales, but let's dive deeper into it so you know exactly how to calculate it.

To begin, you need to decide what time period you want to measure. If you are looking at Q1 of 2022, then you will gather all sales made during those three months (January through March). Consider only the original sales price when calculating your gross sales. Disregard any discount or promotion you were running.

Find your exact sales numbers by logging into your POS system or online sales dashboard. In order to track progress, it's smart to keep track of this in a separate spreadsheet as well.

If your POS dashboard includes discounts and allowances, it might already calculate net sales for you, so you'll need to figure that out on your own.

Calculate the exact amount of each product you sold. Maybe you sold 50 units of Product A and 75 units of Product B. Product A costs $299 and Product B costs $199.

Therefore, your gross sales will be (50 x $299) + (75 x $199), or $29,875.

When you dig a bit deeper, you find that 10 units of Product A were given a discount of 25% off because of early payment, which you will use to calculate your net sales.

As an example, you would take 25% of $299 ($74.75), multiply it by ten ($747.50), and subtract that from your gross sales ($29,875 - $747.50) to show net sales for the quarter of $29,127.50.

Example of how to find gross sales

Let's look at a real-life example. Using an ecommerce business as an example, we'll show you what this may look like for your own retail business.

Our made-up case study will be based on Shopify store nomz. On their website, we can see that they sell organic, vegan, and paleo snacks.

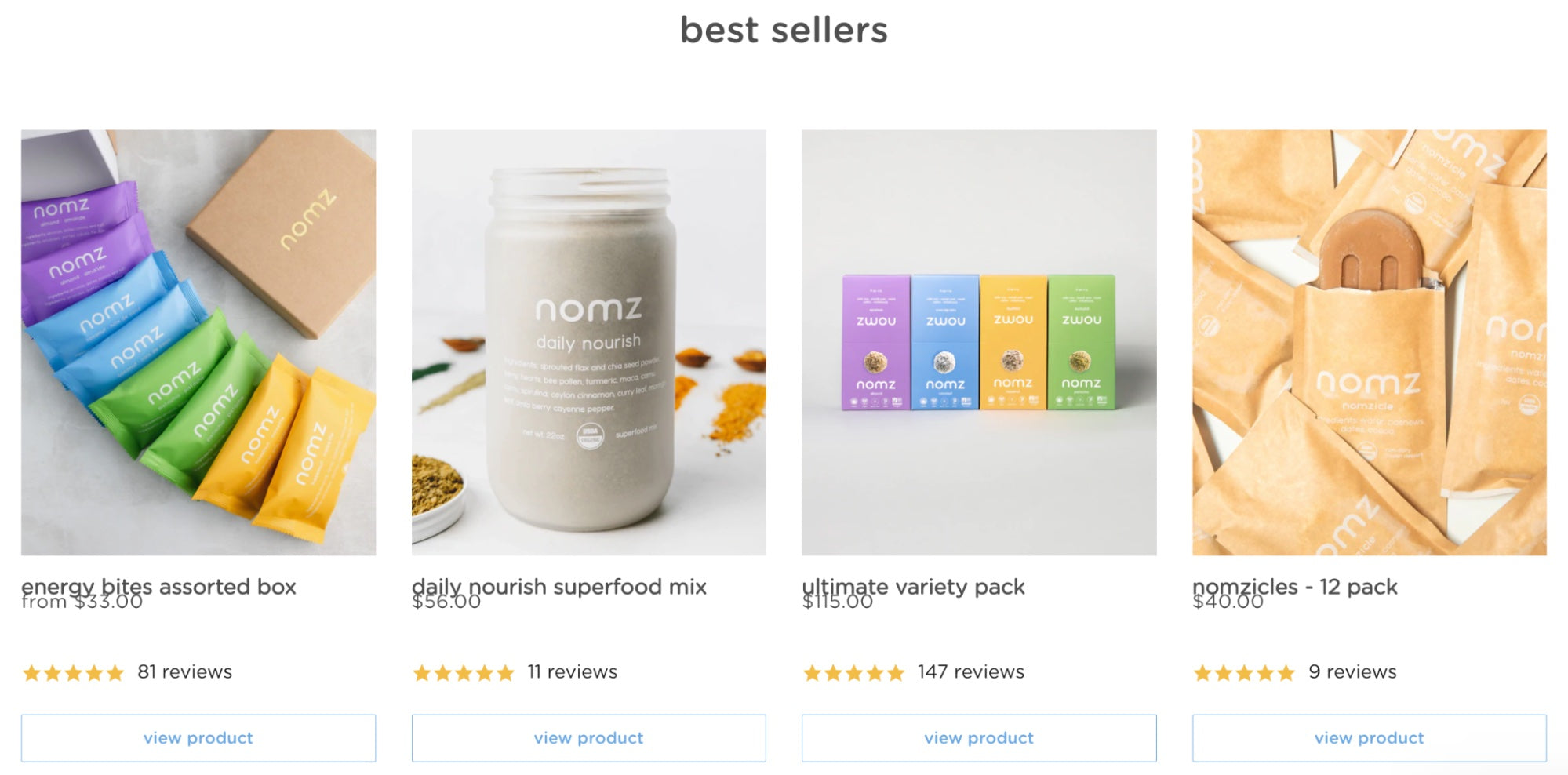

From the list below, we can see that nomz offers a number of products. We'll examine only a few of their self-proclaimed best sellers in this case study.

The company features four best-selling products on their home page: Energy Bites Assorted Box, Daily Nourish Superfood Mix, Ultimate Variety Pack, and a 12-Pack of their Nomzicles.

To determine whether sales are steadily increasing, we want to compare sales revenue for March 2022 with February 2022. First, we need to determine how many of these top four products have been sold.

Let's assume the numbers look like this:

- Energy Bites Assorted Box — 127

- Daily Nourish Superfood Mix — 346

- Ultimate Variety Pack — 72

- Nomzicles - 12 Pack — 298

Next, we need to determine the number of products sold by their original sale price.

- Energy Bites Assorted Box — 127 x $33 = $4,191

- Daily Nourish Superfood Mix — 346 x $56 = $19,376

- Ultimate Variety Pack — 72 x $115 = $8,280

- Nomzicles - 12 Pack — 298 x $40 = $11,920

In total, gross sales for March 2022 were $43,767. By comparing them to gross sales in February and January, we can see fluctuations in gross profit. From these totals we can subtract deductions, such as discounts, allowances, and returns, in order to see what the net sales were.

Knowing how to calculate metrics yourself is a great way to get a better feeling for what the numbers are saying.

💡 PRO TIP: Only Shopify POS unifies your online and retail store data into one back office–customer data, inventory, sales, and more. View easy to understand reports to spot trends faster, capitalize on opportunities, and jumpstart your brand’s growth.

What gross sales can tell you

Why should you care about metrics like gross sales? Because gross sales figures can help you discover a variety of things about your business.

Revenue during a specific period

As we said, gross sales shows your total revenue during a certain period, whether the last month, quarter, or year.

You can track growth trends by looking at data like this, as well as understand the ebbs and flows of your industry to help with demand forecasting. Most industries experience periods of slow sales throughout the year. January tends to be the slower month for the retail industry.

Depending on your product offerings, this may differ for you. Knowing your revenue during that time period each year can help you plan for those slow retail months.

Consumer buying trends

Calculating your gross sales can also give you a deeper insight into how many units of each product were sold over a period of time. This information can give you a good idea of consumer preferences and buying trends. You can also see if the most popular products change with the seasons.

Take note of your most popular products so you can better serve customers with similar products. If you have any products that simply aren't selling, you can move them to your website's home page to attract more attention, highlight them at the cash wrap, or offer discounts to boost sales.

Knowing your gross sales helps you understand how product moves through your business, how much revenue your store is generating, and what your customers are purchasing. Make sure you track these metrics monthly, quarterly, and annually so you know where your business stands.

💡 PRO TIP: To see how much a customer has spent with you when shopping both at your store and online, select their customer profile in Shopify POS.

Calculate gross sales for your store

To measure success, take a close look at your company's sales figures. Calculate your gross sales, net sales, and profit. Using the formulas in this article, you can get a clear picture of your business's total revenue and cash flow.

Set realistic sales goals for your retail business based on these numbers. Setting goals can inspire your team to work aggressively to achieve them, maximizing business growth.

Read more

- How to Calculate the Value of Your Inventory

- 5 Ways Retailers Can Generate Revenue Outside of Business Hours

- Recurring Refunds: How Retailers Can Deal with ‘Serial Returners’

- How Retailers Can Create and Execute a Wholesale Strategy

- 8 Effective Suggestive Selling Techniques for Retailers (+ 7 Bonus Tips)

- Retail Sales Tips: 4 Techniques + 16 Retail Selling Tips to Help You Succeed

- Return Fraud: How to Spot Scammers in Store and Protect Your Bottom Line

- How to Put Together a Loss Prevention Plan for Your Store

- Vision Board for Business: Use This Creative Tool to Accomplish Your New Year’s Resolutions

- Cutting Costs: 14 Ideas to Lower Retail Expenses Without Killing Product Quality