Maximizing profit in retail often hinges on mastering your ending inventory.

This overlooked yet powerful inventory management metric helps you optimize stock levels, reduce inventory costs, and boost profits. It’s important to get it right, as it impacts your balance sheet and taxes.

This guide shows you how to calculate ending inventory, with examples and tips to help you control inventory accurately, with less stress.

What is ending inventory?

Ending inventory, or closing inventory, is the total value of goods you have available for sale at the end of an accounting period, like the end of your fiscal year. It’s an inventory accounting method that helps retailers determine net income, obtain financing, and run accurate stock checks. You record ending inventory on the balance sheet at market value or a lower cost, depending on the method you use.

What is inventory value?

Inventory value is the total dollar value of the inventory you have left to sell at the end of an accounting period. You’ll often see it listed on financial statements, including your balance sheet, at the end of an accounting year.

In simple terms: If you start the month with $500 worth of items and sell $300 worth of stock, your ending inventory would be $200.

Why do you need the ending inventory calculation?

Your ending inventory balance isn’t just a metric to keep an eye on at year end. It’s an inventory valuation method to consider throughout the year. Here are four reasons why.

1. Accurate inventory count

“Completing a full physical inventory count is the best way to calculate your ending inventory and start the new year on the right foot,” says Jara Moser, digital marketing manager at Shopventory.

“While counting every product in the store seems tedious, it ensures the products on your shelves match what’s in your books. It also means getting eyes on inventory hiding in the corner of your backstore and discovering operational trends, such as receiving errors.”

If the ending inventory for your homeware line is $5,000 but you only counted $4,650 worth of finished goods in your stockroom, for example, you have phantom inventory and it’s time to investigate what’s causing inventory shrinkage. Employee theft, return fraud, or shoplifting could be the issue.

Accurate inventory counting helps plan your open-to-buy budget, too. There’s not much sense in investing $10,000 into new stock if you have $7,500 worth of unsold inventory. Avoid relying on intuition and ordering excess safety stock if sellable products are lingering in your stockroom—a well-organized stockroom can help mitigate this issue as well.

2. Calculate net income

Net income is one of the most important financial metrics for retailers to consider. It’s the money left in your bank account after paying for expenses—such as staff salaries, tax, and production costs—over a given period, usually shown on an income statement.

Compare your ending inventory value against your net income to see whether you’re overpaying for goods or underpricing stock.

For example, if your ending inventory is $25,000 but your net income is just $20,000, you’re holding more money in inventory than you’ve generated in sales. Overpaying for stock could be the issue. Consider negotiating with suppliers or increasing product prices for a better ratio of net income to ending inventory.

3. Inform future reports

Once your year end passes, the ending inventory recorded on your balance sheet acts as the beginning inventory for the following year. Get your calculations wrong, or use a combination of methods (more on that later), and you’re setting yourself up for future problems.

Let’s put that into perspective and say your ending inventory for 2022 was valued at $50,000. Going into the next year, that figure would be listed as your starting inventory. Once 2023 ends, you’ll use it to calculate your ending inventory for that financial year. That’s much easier to do if the ending inventory for the year prior was accurate.

4. Obtain financing

Whether you’re looking for extra cash to buy more inventory or take on new retail associates, lenders will want to see your financial statements before approving a funding.

Loans exist to help retailers get started, survive tight financial periods and take advantage of growth opportunities when cash-flow is lean. They’re available so you don’t join the 82% of small businesses who shut up shop because of poor cash-flow management.

“From opening a second retail location to manufacturing your own product line, lenders need an accurate portrayal of your business,” explains Jara.

“Accurate inventory valuation, stock counts, and sales records are key. Proper inventory management eases financial obstacles and gives lenders insight into your profitability and demand volume.”

Ending inventory is one metric lenders look at, because it’s considered an asset. They may be more willing to give your business funding—on more favorable terms—if the business has a low debt-to-asset ratio.

How to calculate ending inventory

Knowing your ending inventory gives you greater control over stock-related and financial decisions.

So, how do you calculate it? Below are six inventory valuation methods to choose from.

Bear in mind that whichever method you choose, you’ll need to stick with it. Financial reports become inaccurate—and the chance for mistakes become higher—if you’re switching between multiple ending inventory methods.

💡 PRO TIP: Rather than wait until the end of the year, view the Month-end inventory value report in Shopify admin to get a snapshot of your inventory’s cost, ending quantity, and total value each month. If you see negative ending quantities, that’s a sign your inventory quantities for that product are incorrect and need to be reconciled.

Ending inventory formula

The simplest way to calculate ending inventory is using this formula: Beginning inventory + net purchases - cost of goods sold (COGS) = ending inventory

For example, if your beginning inventory was worth $10,000 and you’ve invested $5,000 in new products, you’d be sitting on $15,000 worth of inventory. Minus the $12,000 worth of products you’ve sold through the same period, ending inventory would be $3,000.

FIFO method

Other retailers prefer to calculate ending inventory using the first in, first out (FIFO) method. It assumes that the oldest items you bought were sold first, and is used by accountants throughout periods of economic uncertainty.

Let’s say you’re calculating the ending inventory for your retail store. You bought 150 candles at $7 each. Mid-way through the year, a supplier increased their prices. You bought another 150 candles at their new $9 price. That’s 300 candles purchased at a total cost of $2,400.

Your order management system shows 130 candle sales at the end of the accounting period. You bought the $7 candles first, so COGS would be calculated as $7 x 130 = $910.

You’d then use the FIFO method to calculate ending inventory: Beginning inventory ($5,000) + new purchases ($2,400) - COGS ($910) = ending inventory ($6,490).

LIFO method

The last in, first out (LIFO) method is another common way to calculate ending inventory. It assumes that products purchased most recently are the first items to be sold.

Using the same example as above, COGS would be calculated with the new $9 candle supplier price point (since those candles were ordered most recently). Selling 130 candles would mean your COGS is $1,170.

That would make the ending inventory formula: Beginning inventory ($5,000) + new purchases ($2,400) - COGS ($1,170) = ending inventory ($6,230).

Weighted average cost method

The weighted average cost (WAC) method is the middle ground between FIFO and LIFO. It gives an average of how much each stock keeping unit (SKU) is worth by dividing the total cost by the volume of inventory you have in your stockroom.

Sticking with the same example: $2,400 (cost of purchases) / 300 (number of items purchases) = average cost of $8 per candle. When we multiply this by 130 candle sales throughout the year, the COGS would total $1,040.

Here’s what that would look like: Beginning inventory ($5,000) + new purchases ($2,400) - COGS ($1,040) = ending inventory ($6,360).

Gross profit method

Gross profit, also known as gross margin, is the percentage of profit you’ll make on each product after subtracting the cost to produce it. Use this figure to calculate ending inventory using the following formula:

- Beginning inventory + COGS = total cost of goods available for sale

- Gross profit x sales = estimated cost of goods sold

- Total cost of goods available for sale - cost of goods sold = ending inventory

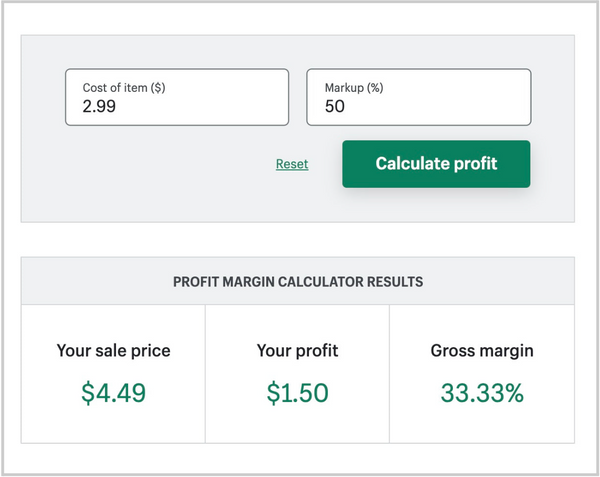

PRO TIP: Confused with all the math? Speed things up with this free profit margin calculator.

Retail method

Designed for stores that do physical stock checks, you’ll need a few metrics on hand before using the retail inventory method to calculate ending inventory:

- Cost-to-retail ratio: (Cost / retail price) x 100

- Cost of goods available for sale: Cost of beginning inventory + cost of goods purchased

- Cost of sales: Dollars earned from sales x cost-to-retail ratio

From there, calculate ending inventory with this formula: Cost of goods available for sale - cost of sales = ending inventory.

Examples of ending inventory

After a sale

Let’s say a clothing store starts the month with an inventory of 200 shirts priced at $20 each. If they sell 150 shirts during the month, the remaining 50 shirts in their ending inventory would be valued at $1,000 (50 shirts x $20/shirt) using the ending inventory formula.

After buying more stock

Now, consider a bookstore that starts with 100 books costing $10 each. Midway through the month, they purchase another 100 books at $12 each. If they sell 120 books in total for the month, they would be left with an ending inventory of 80 books.

However, because they use a first in, first out (FIFO) accounting method, the first 100 books sold are assumed to have cost $10 each, and the next 20 books sold would have cost $12 each. So, their ending inventory would be worth $840 (20 books x $12/book + 60 books x $10/book).

After accounting for loss

Imagine a grocery store that starts with inventory worth $10,000. They add another $5,000 worth of goods during the month but discover at the end of the month that some produce has spoiled, reducing their inventory value by $500. If they sold $7,000 worth of goods during the month, their ending inventory would be $7,500 ($10,000 + $5,000 - $7,000 - $500) using the ending inventory formula.

Read more

- How to Calculate Beginning Inventory & Give Stock a Dollar Value

- A Retailer’s Guide to Reorder Points and the ROP Formula

- What Is Last Mile Delivery Logistics?

- Purchase Orders: How to Create, Manage, and Use POs for Your Retail Store

- A Complete Guide to the Retail Inventory Method (RIM)

- 10 Ways On-Demand Manufacturing Can Help Retailers Streamline Their Operations

- Keeping Up With Demand: Tactics to Boost Productivity And Get Orders Out on Time

- Diversify Your Offerings: Takeaways From 5 Service-Based Businesses Turned Retailers

- 4 Inventory Valuation Methods for Retailers (+ How to Choose One)

- The Complete Guide to Purchasing Product Samples