Almost all businesses will go through periods of financial uncertainty where business cash flow can be an issue. Customers or clients could drop off unexpectedly, a product launch may not go as well as you hoped it would, or the economy might be suffering.

What would you do if your business faced a challenging financial period sometime in the future? Are you prepared to weather the storm?

As an agency owner or freelancer, there’s one key thing you need to focus on—keeping your business alive during difficult times.

If you do this work now, you’ll prepare your business in the event of an economic downturn, putting you in the best position to withstand slower periods. Furthermore, it can even set you up to seize opportunities when the market rebounds.

As chartered accountants and business advisors to digital agencies, we have been in “battle stations” preparing our clients for potential economic challenges. In this article, we unpack the playbook to share how you can prepare your business, too.

The Business Cash Flow Playbook

- Phase 1: Stabilizing and protecting your business cash flow

- Forecast your cash position for the next 13 weeks

- Understand your customer risk

- Analyze the profitability of your customers

- Assess the credit risk of your customers

- Provide more value for the same price

- Phase 2: Strategic financial planning (6- to 18-month lens)

- How to develop a financial budget

- Calculate your break-even point

- Calculate your break-even point under scenario modelling

- Calculate your break-even point as a solopreneur or freelancer

- Phase 3: A systematic approach to cost restructuring and downsizing

Phase 1: Stabilizing and protecting your business cash flow

The first phase of the plan is to stabilize your financial position for the next three months.

It’s possible that your current income may not have fallen off a cliff, but your current pipeline of projects may be put on hold for the time being. This means the sales that you banked on may not end up closing. We need to plan accordingly.

It all comes down to intimately understanding your business cash flow position.

Forecast your cash position for the next 13 weeks

Intimately knowing your cash flow position is what will keep your business alive.

"Intimately knowing your cash flow position is what will keep your business alive."

You can keep on top of things using your accounting system, which will tell you how much you have now. But, in order to look forward and forecast your financial position for the future, you will need another tool in your arsenal.

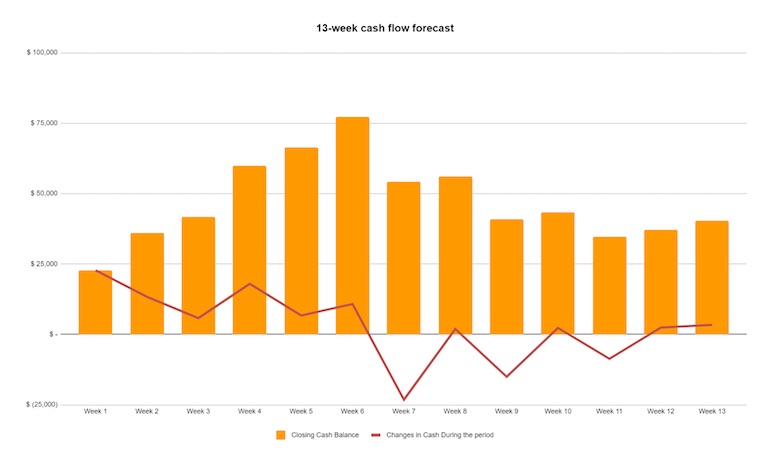

This tool is what finance buffs call a 13-week rolling cash flow forecast. Essentially, it’s a spreadsheet that helps you forecast what your cash balance will look like on a weekly basis for the next three months. Its purpose is to quickly show you what business cash flow "gaps" you may have in your business and how you should respond accordingly.

Doing a weekly cash flow forecast will help inform the following:

- When is my cash flow expected to dip?

- How do we close the cash flow gap?

- What options are available to me, like a line of credit or financing, to fund any cash flow gaps?

- What does our business look like with customers paying us later, or even churning on our retainer-based contracts?

- Are there any government or bank programs we can access to help close the gap?

Work with your accountant and bookkeeper to map out this forecast. This is the time when you need them the most.

You might also like: How Shopify Partners are Responding to COVID-19.

Understand your customer risk

Once you have a lay of the land with your business cash flow forecast, the next step is to understand your financial exposure to your customers.

Conduct a customer risk analysis to estimate customer profitability and credit risk. This framework will help you:

- Understand your exposure to churn and cash inflow due to unprofitable accounts or high-risk debtors

- Assess your current revenue and cash flow streams

Here’s how to do it.

Analyze the profitability of your customers

Step 1: Export a sales report from your accounting system to a spreadsheet. Filter this data by customer name and dollar value of sales for the last 12-month period.

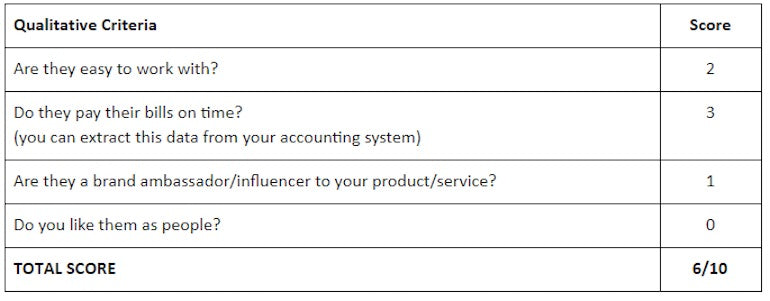

Step 2: For each customer, ask yourself the following questions:

- Are they easy to work with?

- Do they pay their bills on time?

- Are they a brand ambassador/influencer to your product/service?

- Do I like them as people?

For questions 1, 2, and 3, assign a score from 0 to 3 (0 being terrible, 3 being amazing).

For the fourth question, make that one binary: it’s a 0 or 1.

Tally your results to give you a qualitative score out of 10 for each customer.

Example:

The process of allocating a score against each question helps you to assess your customers objectively. This quantification serves to eliminate any biases you have to your customers.

Step 3: Calculate the average direct cost to service each customer (via time invested and charge-out rate) and enter the value in a new column. You can pull this from your time-sheet data or project management system.

Step 4: Calculate the gross profit earned on each customer and then the gross margin by deducting the average costs to service each customer from the sales dollars.

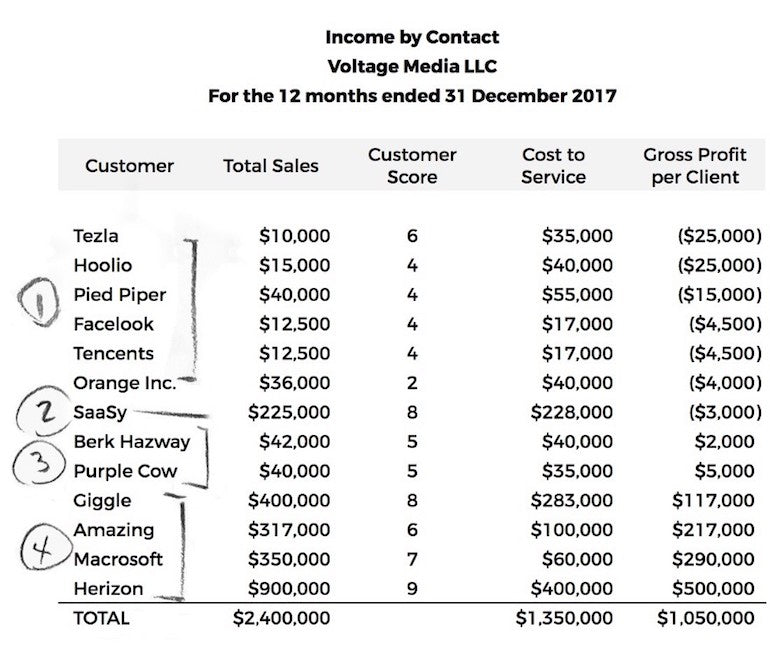

Step 5: Filter the spreadsheet by gross profit amount of each customer and rank from Step 2. This is now the result-ranked list of both your profitable and unprofitable customers.

Here are some key observations from the sample table above:

- The customers under “Note 1” are the ones that are losing you money. They rank low on the qualitative “customer score,” and they are costing you. You should consider firing them or increasing their prices.

- The customer SaaSy under “Note 2” is less binary. This company brings in a lot of revenue, and is ranked highly on the customer score. However, it is being serviced unprofitably. It’s fundamentally a great customer to work with, as it’s ranked eight out of 10, but ultimately, you cannot continue to service them profitably. In situations like this, dig deeper to understand why this client is unprofitable. Are you perhaps over-servicing them or not producing their work efficiently? Use this as a prompt to unearth the underlying issue.

- The customers under “Note 3” are fence-sitters. They rank in the middle from a customer perspective, and they generate a small profit to the business. You’re okay to hang on to these customers, but keep track of how they rank in the future.

- As for those in the “Note 4” bucket, these customers rank highly on the customer score, and bring in the most profit to the business. Notice how the profit generated from these four clients carry the losses of the bottom half? These are the customers you want to nurture the heck out of.

You might also like: How to Build Strong Relationships with Clients in Another Time Zone.

Assess the credit risk of your customers

Once you have ranked your customers by profitability, the next phase of the process is to understand their risk of churning or not paying your current invoices.

We recommend the following steps:

1. Do a risk assessment of each of your customers and understand their ability to pay their current invoices.

- If there are any laggards, pick up the phone and get them to pay their outstanding account.

- If they are paying on time, offer a payment plan. Get them to commit to a small, affordable weekly repayment on direct debit (or via credit card to help their cash flow).

2. Secure contracted revenue.

- Review your existing contracts/terms and conditions and ensure you have built in robust termination clauses so you have plenty of notice if customers decide to cancel their contract with you.

- It’s inevitable that some customers may ‘fire’ you. Just make sure you have plenty of notice and time to prepare for that scenario.

The objective of this is to understand your credit risk in the event that any of your customers ask for extended payment terms or, unfortunately, are at risk of insolvency altogether.

Provide more value for the same price

Now is the time to double down on your best customers that generate the gross profit to your business, as identified in the customer profitability analysis. The objective is to prove your value to your most profitable customers, and show them that they need you more in this time of economic uncertainty.

"Now is the time to double down on your best customers that generate the gross profit to your business."

Brainstorm with your team and ask, “How can we position our product/services to help our customers weather this economic storm?” Develop a list of potential initiatives and additional offerings you can provide to help your best customers weather the uncertainty. Consider providing these at a discounted rate, or divert existing services into this new offering.

It’s important to note that this process is not to "squeeze every dollar" out of your customers.

The objective is customer retention and shoring up your business cash flow so you can rely on that cash to make financial decisions.

Divert all efforts to engaging with your best customers, and be a partner that they can lean on in these times.

You might also like: Crisis Communication: How to Talk to Clients During COVID-19.

Phase 2: Strategic financial planning (6- to 18-month lens)

Phase 1 was all about stabilizing your business’s financial position for the next three months.

Once you have completed this step, the next phase is to assess your business from a longer time horizon, looking 6-18 months into the future.

Practically, this means:

- Building/refining a financial budget for your business

- Calculating your break-even point under scenarios

- Calculating your Minimum Viable Lifestyle (for solopreneurs and freelancers)

How to develop a financial budget

Put simply, a budget is a financial plan. It’s a tool used to quantify your business’s strategy over a time period.

While the 13-week business cash flow forecast outlined above is focused on the next three months, a financial budget is typically built for a one- to two-year period.

The purpose of this tool is to:

- Develop estimates of future fixed expenses

- Understand your break-even point for sales

- Help you with scenario analysis to understand how changes in your revenue will impact your break-even point

Calculate your break-even point

You may be familiar with the term "break-even point", which calculates the number of sales you must make before all your business expenses are covered and the profit begins.

For agencies and service-based businesses, the majority of your expenses are what we call "fixed costs". What this means is that irrespective of what your revenue is month-to month, your costs will always stay the same. For your business, these costs will be predominantly wages, rent, utilities, and insurance.

"For agencies and service-based businesses, the majority of your expenses are what we call ‘fixed costs’. What this means is that irrespective of what your revenue is month-to month, your costs will always stay the same."

Therefore, calculating the break-even point for your agency business is a fairly straightforward exercise. We can do this by understanding your monthly fixed expenses, then calculating the total sales you need to make each month to cover them.

The purpose of calculating your break-even point is to set yourself a benchmark of monthly sales you need to generate in order to “survive.” Trading at a break-even point for your business should be ground zero.

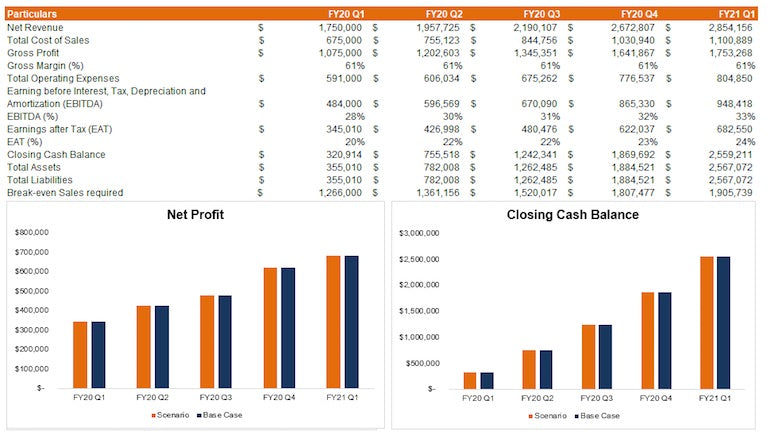

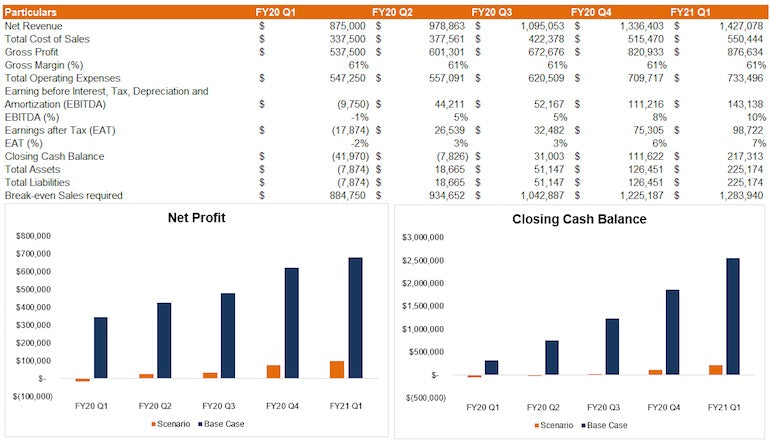

Calculate your break-even point under scenario modelling

Your financial budget is built upon principles of the past. You have established what your monthly expenses are; you know what your average monthly sales are based on historical activity.

But what happens if your sales dry up 6-12 months from now? How would you respond as a business owner and leader?

The next phase of the playbook is to “wargame” your business under a set of different scenarios. The goal here is to stress test your business and help you develop a plan of action in the event that conditions deteriorate over the coming months.

With your newly-developed financial budget, calculate your monthly expenses profit/loss based on the following scenarios:

- Moderate loss: 15 percent decline in revenue

- High loss: 25 percent decline in revenue

- Extreme loss: 50 percent decline in revenue

From here, we can understand the gaps in your profit and business cash flow. This will guide a decision-making framework to help us prepare and plan for each scenario on:

- Operating costs restructure

- Pricing decisions

- Cash flow gaps and access to capital

Start by asking yourself the following questions:

- What does your business look like under each of the scenarios?

- What costs will you have to cut to get back to break-even under each scenario?

- If you’re willing to take a short-term hit, what is the burn rate and what funding (via debt or equity) is available for you to make up the cash flow gaps?

Next, develop an action plan for each scenario. The objective here is to prepare for a worst-case scenario in a calm, cool, and collected state of mind. The last thing you want to do as a leader is to make panicked, irrational decisions, as those can cripple you later.

"The objective here is to prepare for a worst-case scenario in a calm, cool, and collected state of mind."

And hey, you might find that these scenarios don’t eventuate and your business is okay. But carrying out this process will give you the peace of mind that you have a plan in place in the event that things do go south.

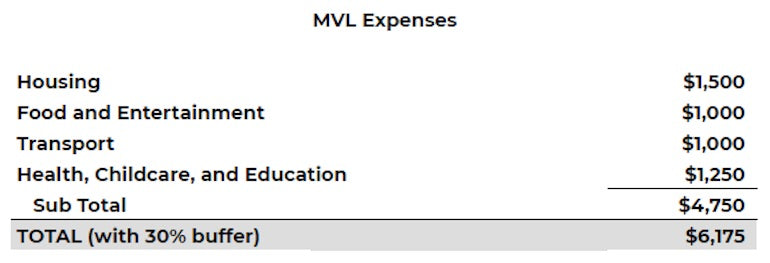

Calculate your break-even point as a solopreneur or freelancer

If you’re a freelancer or solopreneur, you may not have a great deal of fixed costs. In fact, the largest cost of your business is likely your own salary!

Ultimately, your benchmark break-even point comes down to finding a balance of income that gives you enough money now to support the lifestyle you need.

We can determine this by calculating your Minimum Viable Lifestyle (MVL). You may be familiar with the Silicon Valley term Minimal Viable Product (MVP). This phrase was popularized by startup guru Eric Ries in his legendary book, The Lean Startup.

The MVP thesis is designed around building the cheapest and smallest product possible, with just enough features to satisfy your early customers. The idea is to work within a cost constraint that achieves the most viable outcome. The MVP principle can be adapted to disciplines outside of the software and product development world.

As an accountant, I like to apply this perspective to my personal finances. Let’s call this exercise the Minimum Viable Lifestyle (MVL). The idea behind the MVL is to design your lifestyle so that you are living on the lowest viable cost, which still yields the highest impact to your satisfaction. The core principle is that you only spend money on things that have a high personal utility.

"I like to apply this perspective to my personal finances. Let’s call this exercise the Minimum Viable Lifestyle (MVL). The idea behind the MVL is to design your lifestyle so that you are living on the lowest viable cost, which still yields the highest impact to your satisfaction."

The process involves an audit of your personal monthly lifestyle expenses, and eliminating any unnecessary or impulse purchases. The aim is to understand the minimum salary you can live off while still enjoying a satisfactory life.

From a business accounting perspective, figuring out your MVL sets a guide for what your monthly break-even point in sales should be. It’s important to make sure that you cover your MVL so your personal financial situation doesn’t suffer.

I want to emphasize that the key word here is “satisfactory.” An MVL does not mean poverty. It simply means making small sacrifices that still provide you a comfortable quality of life.

Calculate your Minimum Viable Lifestyle

First, put everything on the table. The more expenses and receipts you consider, the better you’ll understand your own number.

Step 1: Review your spending

Take a look at your personal bank and credit card statements for the last month and tally your spending into four categories:

- Food and entertainment

- Housing

- Transportation

- Everything else

Set up a spreadsheet and enter them into columns. To help you categorize these items, here’s a list of the most common expenses and where they should be allocated in your lifestyle budget.

Food and entertainment:

- Groceries

- Monthly subscriptions like Netflix and Spotify

- Takeout

- Gifts

Housing:

- Mortgage repayments

- Rent

- Utilities

Transportation:

- Car repayments

- Car insurance and registration

- Fuel

- Other transportation costs

Everything else:

- Health insurance

- Childcare expenses

- Tuition

- Self-education expenses

- Medical expenses

There may be expenses that don’t directly fit into these buckets. To make this easy, just add them into your “everything else” category. The objective here is not to provide extreme detail in the categories; it’s simply to get a base understanding of your current lifestyle costs.

Step 2: Conduct a lifestyle review

Now that you’ve got a summary of your current living expenses, work with your significant other if you have one (partner, husband, wife, etc.) and review the cost buckets.

Ask yourself, which of them are really necessary? If we go without them, how would that impact our happiness? I’m not suggesting you be a Scrooge here. Your MVL should be the bare minimum of costs to live a comfortable life. Be realistic.

Usually, the biggest gains can be found in the food and entertainment bucket. Think about how small changes can impact your costs. It could be as simple as moving date night out to once a month, instead of once a week. Remember, the less you can live on, the more you can invest back into your business.

Once you’ve identified the “unnecessary” expenses, remove them from the total and re-calculate your monthly lifestyle expenses. This is your new MVL budget.

Step 3: Add a buffer

After totalling your revised lifestyle expenses, add a 30 percent margin to factor in personal taxes and a savings safety net; your fund for “rainy days.” This final number is your monthly MVL.

Your MVL value forms the benchmark of the monthly sales you need to generate in order to survive (plus some).

This framework can also be applied for founders of larger agencies and businesses to inform salary reduction or cost-cutting decisions, as outlined in the next step of the process.

Phase 3: A systematic approach to cost restructuring and downsizing

Let’s be real: it’s inevitable that some businesses will have to downsize their team and cut other costs to maintain business cash flow.

These are tough and often emotional decisions. That means it’s best to plan ahead, and use a framework in order to stay rational.

"These are tough and often emotional decisions. That means it’s best to plan ahead, and use a framework in order to stay rational."

This phase offers a systematic approach to cost restructuring so you can execute in a calm, empathetic, and respectful manner.

The fat, muscle, and bone framework

It may be helpful to think of cost cutting in the following analogy:

- Fat: Nice-to-haves, no major impact on business, potentially low-yield things you got used to in good times.

- Muscle: Things that will impact you and hurt in the short-term. May slow growth and increase workload, but you can build back up over time.

- Bone: Things that will impact the long-term viability of the business and potentially make a permanent mark.

Let’s start from the top.

The fat

Cutting fat is the easiest and most painless place to start. These are often things you’ve let continue or haven’t needed to worry about because times have been good, and growth has masked the inefficiency.

Examples of fat include:

1. Unprofitable accounts and customers

Now is a really good time to truly understand the accounts and customers that are losing you money. Follow the customer profitability framework outlined in Phase 1 and sack those customers. It’s now or never.

2. Superfluous software and subscriptions

Are you really using all that SaaS software? Software subscriptions are the hidden killer of profitability. Those seemingly small $10-$50 per month, per seat subscriptions really add up. Pull up a monthly report from your accounting system and do a line-by-line audit of those subscriptions. Involve your team as well—see if everyone is really using all those seats.

3. Employee leave

If you have employees who have some leave built up, now is a good time to encourage them to take it.

4. Meals, entertainment, non-essential allowances

This is all the nice-to-have stuff in your business. Ultimately, the fat here is pretty obvious, and it’s likely that you have cut most of it from your business already.

You might also like: How to Work Remotely: 4 Tips to Help Your Team Succeed.

The muscle

The muscle is things that will hurt your trajectory, but only temporarily. Like going to the gym, you can build this back up over time.

Examples of muscle include:

1. Paid marketing and advertising

The strategy to cut your marketing and advertising expenses will depend on your business model. There are some business models, like ecommerce for example, that won’t be able to do this. The marketing I’m referring to here is strategic brand marketing—basically anything that doesn’t directly correlate to generating sales now.

2. Business Development

General partnership and strategic business development opportunities can be paused. You can come back to this later. I want to be clear with this one: Business development is not the same as your sales team. Keep on the staff that directly result in revenue.

3. Reducing the number of projects you’re working on

If you’re like most founders, you have an endless list of strategic projects on the go. Look at cutting back some of these and focus on the critical ones, if any at all.

The bone

The bone is anything that will cause great distress and potentially permanent damage to your business, and is a last resort for survival. Yes folks, we’re talking about team redundancies and layoffs.

There are several plays here on how you should approach staff redundancies. You should use judgement to see which best suits your circumstances.

1. Drastic cuts

The idea here is that slowly and unpredictably cutting your team impacts your culture and efficiency. Remaining people start to worry about security and fear spreads while productivity slows.

Under this scenario, you aim to make one drastic cut to downsize your team to essential people for survival, and build back up once you come out the other side. This won’t be possible for all businesses, and is likely suited for companies backed with investment or holding decent cash balances.

2. Trimming

This is the most common approach, but potentially the most harmful to culture. Under this approach you let the minimum number of people go incrementally, based on the business’s cash needs.

This would involve ranking roles from most critical to least critical as a way to decide who will be let go. From the context of agencies, reviewing your staff’s timesheets to understand chargeable time/utilization is a good place to start.

The issue with this approach, particularly for bigger agencies, is the fear and uncertainty that breeds throughout the company. People start to wonder if they’re next, and productivity drops, particularly if they don’t see an upward trend in the company’s prospects.

Sometimes, you have no choice but to do this.

3. Reduced hours or pay cuts

Some other approaches we’re seeing successfully implemented at other companies are:

- Temporarily moving everyone to a four-day workweek

- Temporarily dropping wages by 10-20 percent across the board

- Much higher cuts, but topped up with employee equity

This approach is by far the most favorable for leaders, as it provides a directive to your team that “we’re all in this together.”

None of these decisions are easy

Regardless of which method you take, it’s highly advisable to communicate early, and often. Don’t leave people wondering. If you’re choosing between options, discuss potential strategies with everyone to see what they may prefer. You’d be surprised how many people are willing to take a temporary pay cut to keep their job, or how motivated some people might be by employee equity.

In terms of how to communicate with your team, we advise that you have a status meeting now, regardless of the shape you’re in:

- If you’re doing well, great. Share that with the team so they aren’t wondering.

- If you’re not sure, tell them that you’re keeping a close eye and will update them regularly.

- If there are layoffs or stand-downs coming, give as much notice and information as possible.

Practically speaking, we’re seeing companies keep regular communication in the following methods:

- A very brief weekly Town Hall (five or 10 minutes) on Monday or Friday to update everyone on any changes, and allow for questions

One final note: the silver lining

A financial challenge is never fun for anyone who’s involved, but let’s talk about the silver lining of this environment.

Never waste a crisis.

Now is the perfect opportunity to improve your business. Use this time to cut any fat, improve your business and systems, and clean up the things you’ve been putting off because times were good.

Now is the perfect time for this because everyone is in the same boat. You’re not the only one whose growth is slowing, so you won’t be judged as harshly by investors, the board, employees, or customers.

Preparing for the worst now will set you up to capitalize on future opportunities.

Survival is the first order of business. The second order is coming out the other side stronger.

We hope this guide will put you in a place where you can achieve both while keeping your business cash flow strong.

COVID-19 Response for Shopify Partners

Solidarity and community bring us together. Learn how you can stay connected to the Shopify Partner ecosystem, adjust to these complicated times, and help your clients and users along the way.

Read more