Processing payments is perhaps the most nerve-wracking aspect of running an ecommerce business. Not only does it keep your business’s lights on, but it deals with sensitive customer information.

Most customers may believe the ecommerce payment process takes only a few seconds—as long as the click of a button. But it entails many points of communication between multiple players: customer, merchant, payment processor, merchant account service, and both the customer and the merchant’s respective banks.

The rewards of choosing a payment processing solution that best fits your and your customers’ needs can be major. Not only can you take in more money, but you can capture the 19% of users who are likely to abandon checkout because they don’t trust a site with their financial information.

This guide shares how ecommerce payment processors work, complete with tips on how to find the right one for your own online store.

What is ecommerce payment processing?

Ecommerce payment processing is the system that allows online businesses to accept and process electronic payments for goods and services. It involves the secure transmission of transaction details between customers, merchants, and payment service providers. It’s the processor’s job to authorize, capture, and settle funds.

Ecommerce payment processing vs. traditional payment processing

Traditional payment processing involves an ecommerce merchant using a third-party payment gateway as part of the checkout process. The customer is redirected to an online payment page on the third party’s own website, which serves as the point at which the customer’s payment details are entered to complete the purchase.

Ecommerce payment processing is integrated into your business’s own site. It’s a one-stop shop that builds a higher grade of trust between customer and merchant. When customers are redirected to a third-party site in order to complete a transaction, they become less confident in the security of their sensitive financial information. They are also more likely to abandon their online shopping cart altogether.

What are the main ecommerce payment methods?

- Credit and debit cards

- Mobile payments

- Buy now, pay later (BNPL)

- Bank transfer

There are several payment methods to choose from when buying from an online store. Fail to offer them and you risk losing the 11% of people who’ve abandoned their online cart because their preferred method was unavailable.

Prioritize the most popular ecommerce payment methods when evaluating potential payment processors, including:

Credit and debit cards

This remains the most popular payment method. When customers buy from your store, a processor contacts the issuer (such as Visa, Mastercard, or American Express) for authorization. The funds are transferred to your bank account when approved.

Mobile payments

Roughly half of all ecommerce transactions happen using a mobile device. Mobile payment methods such as Apple Pay, Samsung Pay, and SMS payments make it easier for mobile shoppers to buy online.

Buy now, pay later (BNPL)

Not everyone wants to pay for products in full upfront. BNPL services split the cost into different transactions and automatically bill a customer when their next payment is due. Shopify Payments, for example, offers Shop Pay Installments—a way for customers to break their purchase down into smaller payments. You still receive the total order amount upfront (excluding the fee for using the service).

Bank transfer

With this payment method, a customer signs into their online banking app and manually sends money to an ecommerce business. It’s predominantly used in business-to-business (B2B) ecommerce where transactions are high in value and money is paid after an order has been placed.

Related article

9 Best Ecommerce Payment Gateways & How They Work

Ecommerce payment gateway helps you process online payments. Here are nine of the best to choose from, ranked by their fees and features.

How does ecommerce payment processing work?

1. Customer initiates payment

Many online payments start when the user enters credit or debit card information at the checkout stage, usually by a form embedded in your website or mobile app. Encrypted payment details entered on your website are sent to the processor via payment gateways.

A payment processor is a financial services provider, such as a credit card services provider, that facilitates the ecommerce transaction chain. The payment processor conveys all transaction data between the customer’s bank or credit card company and the merchant’s account.

The payment gateway is a technological platform connecting your ecommerce site to a merchant services provider. This facilitates the transfer of data between the payment processor (and, by extension, the issuing and receiving banks) and the customer-facing website.

2. Processor authorizes the payment

The processor then notifies the bank that issued the customer’s credit or debit card to ensure there are sufficient funds in the associated account. The transaction is either authorized or declined and the information is transmitted back to the ecommerce site via the payment gateway. If the payment is authorized, the customer receives an order confirmation, usually in the form of an email receipt.

3. Funds are transferred to merchant bank account

A merchant bank account allows an ecommerce merchant to receive electronic payments from customers. This occurs after customer payments have been authorized and settled—meaning the funds from the customer’s credit or debit card institution have been deposited into the merchant account. The funds are then transferred to the merchant’s own business banking account, usually after one to two business days.

How to choose the best ecommerce payment processor

- Check security features

- Evaluate accepted payment methods

- Check for international payment support

- Look for tokenization services

- Confirm integrations

- Analyze costs and fees

There are a number of factors to consider before choosing a provider. Let’s explore each so you can find the right ecommerce payment processor for your business.

Check security features

Your site will need an SSL certificate, or secure sockets layer certificate, to securely process payments. An SSL certificate is a code applied to your web server to provide a layer of security for online communication and transactions. When a customer’s web browser contacts your business’s website, the SSL certificate encrypts the connection, effectively shielding customer information from prying eyes.

Once you’ve set up an SSL certificate for your site, ensure your ecommerce payment provider is PCI compliant. PCI stands for payment card industry, a set of regulations merchants must follow to accept payments online. Compliance is mandated by credit card companies to ensure the security of credit card transactions passing through your processor.

Evaluate accepted payment methods

The best ecommerce payment processing solution for your online store will be able to process a variety of payment options—not just a credit and debit card, but PayPal, Venmo, and e-checks too.

Check for international payment support

If your business sells only to the US market, you may not have to consider selecting an online payment processor that allows for international transactions. However, if you plan to have customers overseas, you’ll need to select a service that can facilitate foreign payments.

Your ecommerce payment gateway will need to be able to support credit and debit cards from various foreign banks, and allow users to convert payments to their country’s currency. The gateway should also offer support for navigating various tax systems.

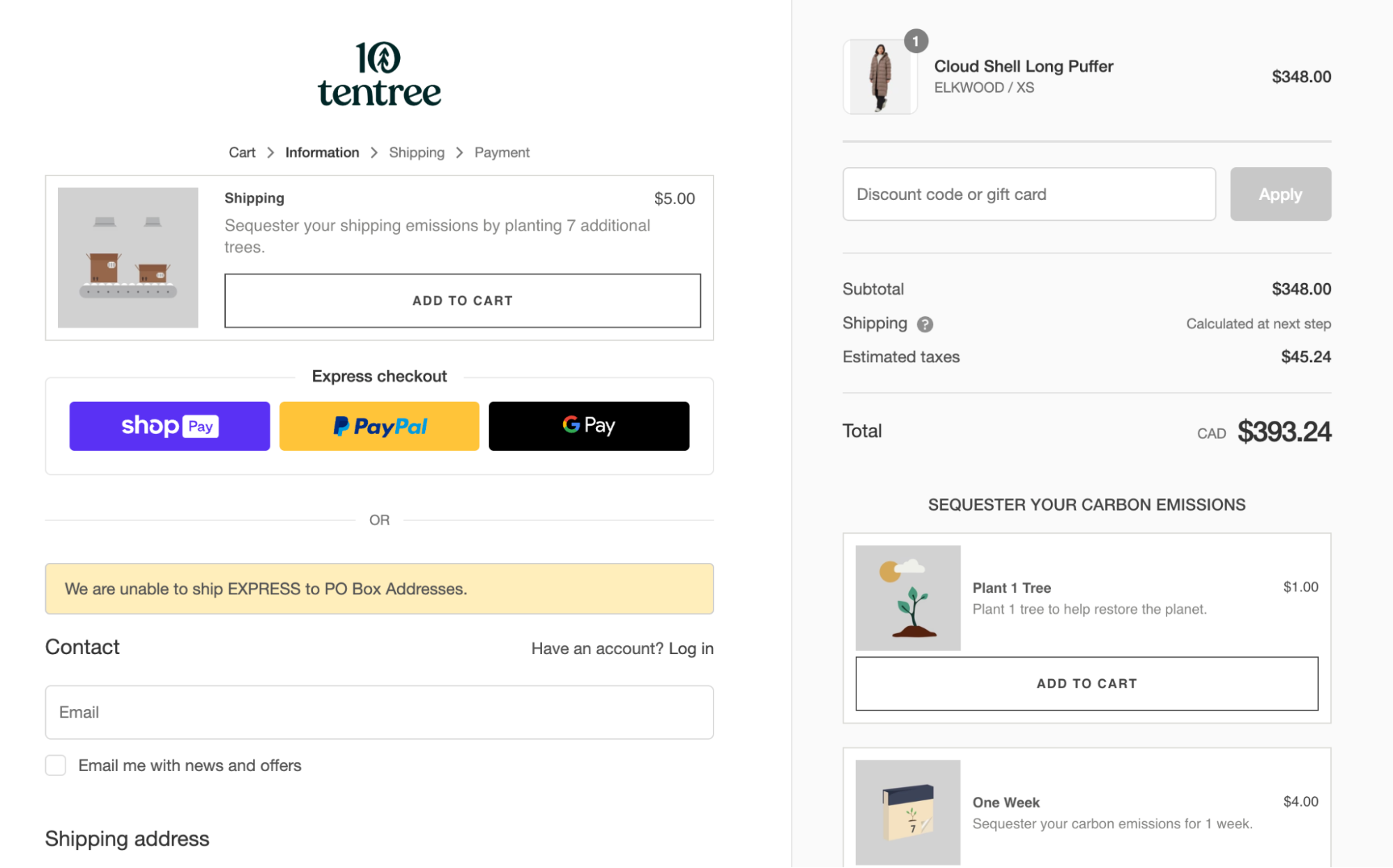

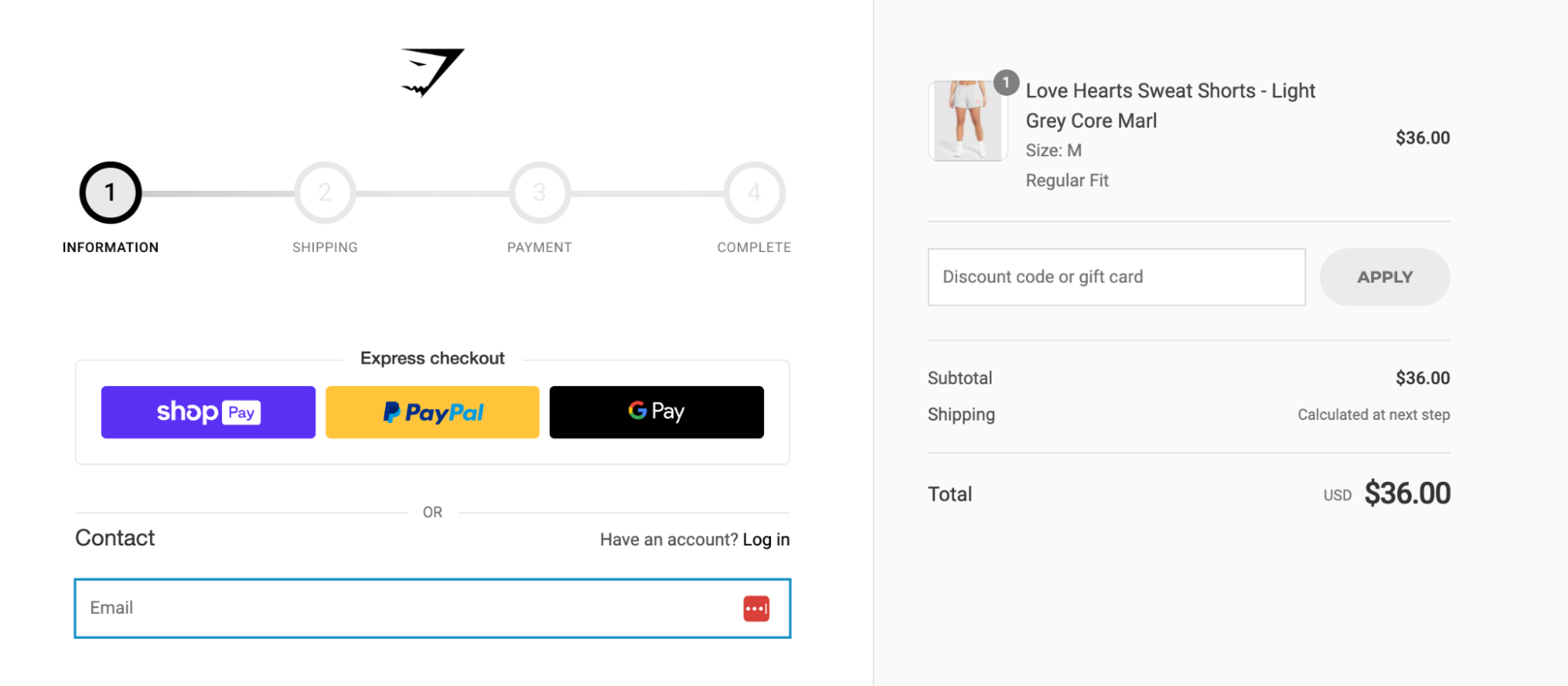

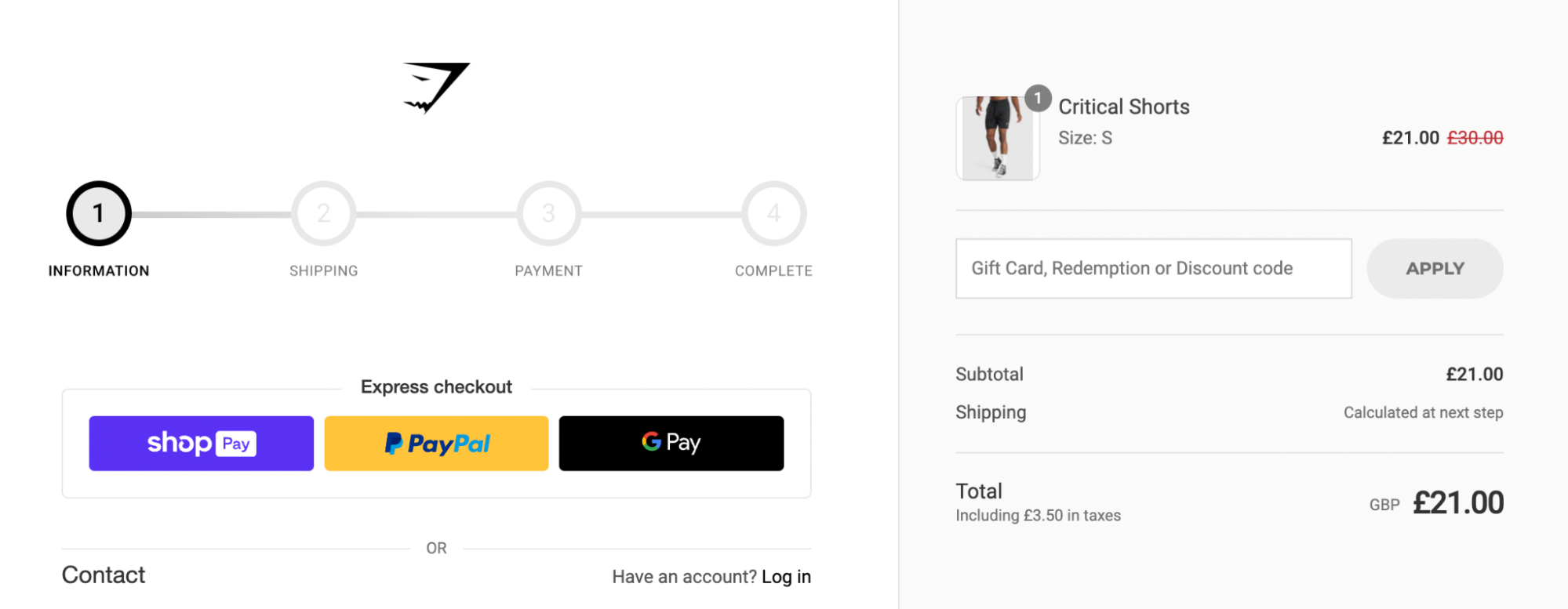

Gymshark, for example, uses Shopify to sell internationally. It has localized storefronts for its biggest markets, each billing customers in their local currency with the applicable taxes for the region.

Look for tokenization services

Want to process recurring payments or charge a card you’ve stored on file? Storing credit card information directly is not advised; the information would be readily accessible to hackers in the event of a data breach.

Some ecommerce payment processors offer payment tokenization to store customer data for later use. Instead of saving customers’ actual credit card details, your site saves a randomly generated alphanumeric code, which represents and replaces customer information in your system. From then on, your platform uses the token instead of card numbers when charging customers.

Confirm integrations

If you’re hosting your store on Shopify, there are thousands of third-party apps to choose from in the Shopify App Store. Confirm your new payment processor is compatible with those you’ve already installed.

Analyze costs and fees

Costs associated with using an ecommerce payment processor can be divided into three main components:

- Set-up costs. Processors will usually charge an initiation fee, ranging between free and $250.

- Monthly subscription fee. These generally fall between $10 and $50.

- Transaction fees. Processors will typically charge between 1% and 5% of each transaction on top of a flat fee, usually no more than 25¢.

Examples of ecommerce payment processors

You’ll need a payment processor to take payments from customers who buy products through your online store. Many popular payment processors integrate with ecommerce platforms and the technology that works with them.

Shopify Payments is the most popular processor for merchants who use the Shopify platform. It can collect payments from online customers without complicating your toolstack.

Plus, it eliminates third-party transaction fees and offers customers more flexibility. When Shopify Payments is enabled on your ecommerce store, customers can pay in installments, use one-click checkout, and securely store credit card details for repeat purchases.

If you’re selling in person alongside your website, Shopify Payments can handle all types of payments. Use the processor to accept chip and PIN, contactless, or mobile payments on Shopify POS, then sync the data with transactions processed through your online store.

Other ecommerce payment processors include:

- Stripe

- Adyen

- PayPal

- Klarna

- Amazon Pay

Improve customer experience with slick ecommerce payment processing

Selecting the right ecommerce payment processing solution is one of the most important decisions a business owner can make. Consider the security features offered, whether they accept international payments, and the fee schedule to identify the best payment processor for your online store.

Remember, choosing a payment processor is only the first step in processing payments. Prioritize the customer experience when setting yourself up to take payments. Speedy checkouts win; security is essential.

Read more

- Level up Order Management and Fulfillment With Mobile

- What Every Small Business Needs to Know About Accrued Liabilities

- 7 Common Shipping Questions and How to Prepare Before They're Asked

- Guide to ACH Deposits- How ACH Deposits Work

- EFT vs. ACH- What Are the Pros and Cons of Each?

- What is Customer Lifetime Value (CLV)? Definition and Guide

- Business Renters Insurance- A Guide for Business Owners

- EFT Payments- What Are Electronic Fund Transfers?

- From Realtor to Retailer- How Strategic Financing Helped One Entrepreneur Scale Quickly

Ecommerce payment processing FAQ

What are the best payment processor for ecommerce?

- Shopify Payments

- Stripe

- PayPal

- Klarna

- Adyen

- Amazon Pay

What is essential in ecommerce for processing payments?

How do I accept payments on ecommerce?

- Choose a payment processor.

- Sync the processor with your ecommerce platform.

- Choose which payment methods you’ll accept.

- Set a payout currency and schedule.

- Run a test payment.

- Launch and monitor the new payment system.